Brazil's development has primarily unfolded along its extensive coastline, where the majority of the population, infrastructure, and overall advancements are concentrated. Due to this process and to the presence of Amazonian rainforest, the North region has suffered from late development, with a lack of necessary investments in infrastructure, especially those related to transportation. This fact has led to numerous issues in passenger and freight transportation as well as the region's overall supply chain, encompassing challenges like inadequate infrastructure and safety, increased travel times and higher tariffs, adversely impacting the regional population.

The most part of the transportation infrastructure of the Northern Region was developed between 60s and 70s, during the Brazilian military regime. Even with the recent governmental efforts to improve infrastructure with programs like the “Programa de Aceleração de Crescimento (PAC)” and to carry out concessions and PPPs in Brazil, very few concessions have been granted in the North region and the investments are still insufficient, both from public and private sectors. Despite ongoing advancements in air transport, the region heavily relies on river transportation for the movement of passengers and freight, leading to significant bottlenecks, particularly within land transportation.

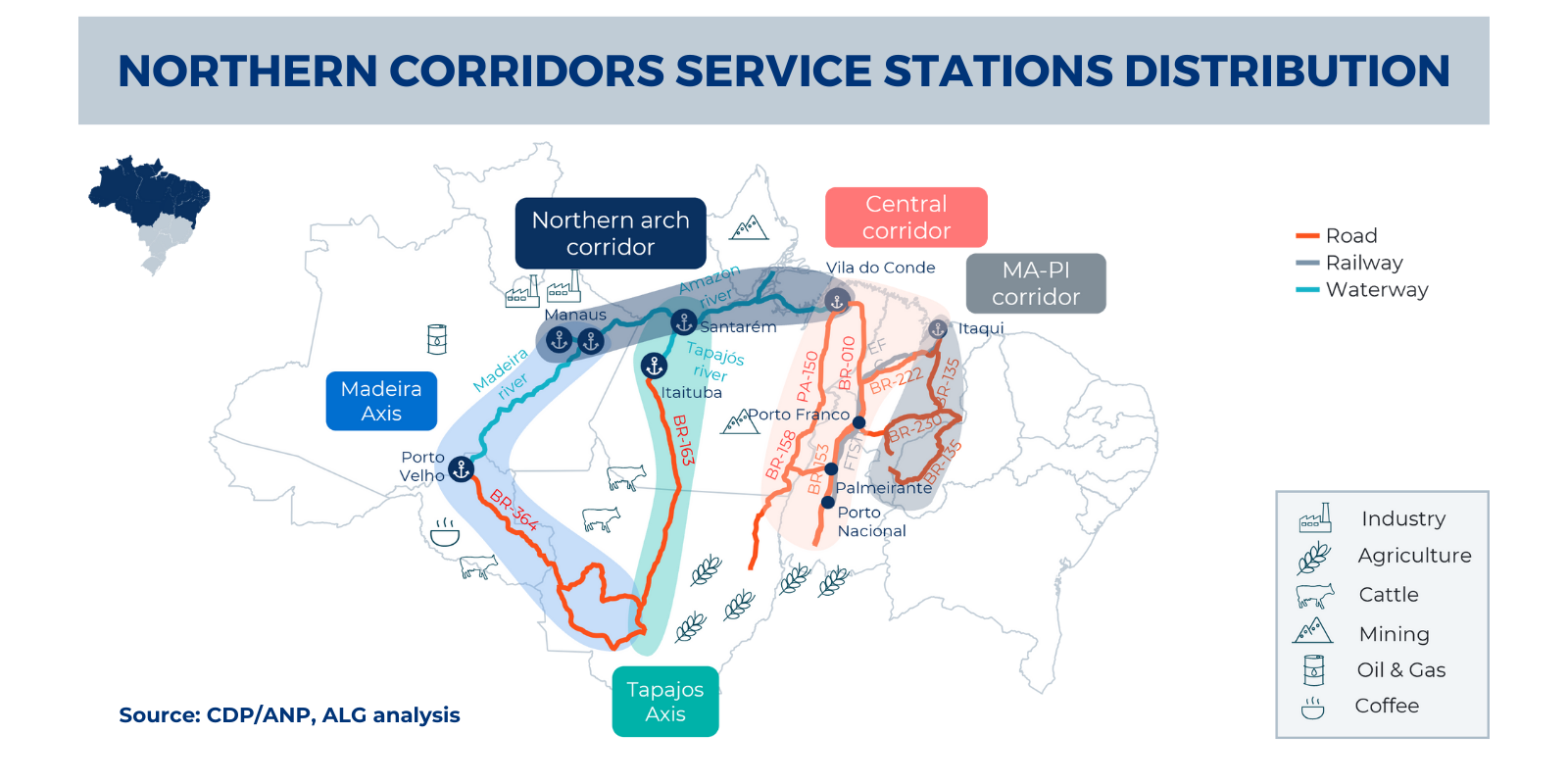

The transportation inside Amazonia is characterized by few long logistics corridors, heavily depending on the Northern arch corridor, which can be accessed only by inadequate roads. Therefore, the transportation of several types of cargo are affected: mineral bulk, agricultural bulk, industrialized products of the Manaus industrial pole, etc.

Land transportation

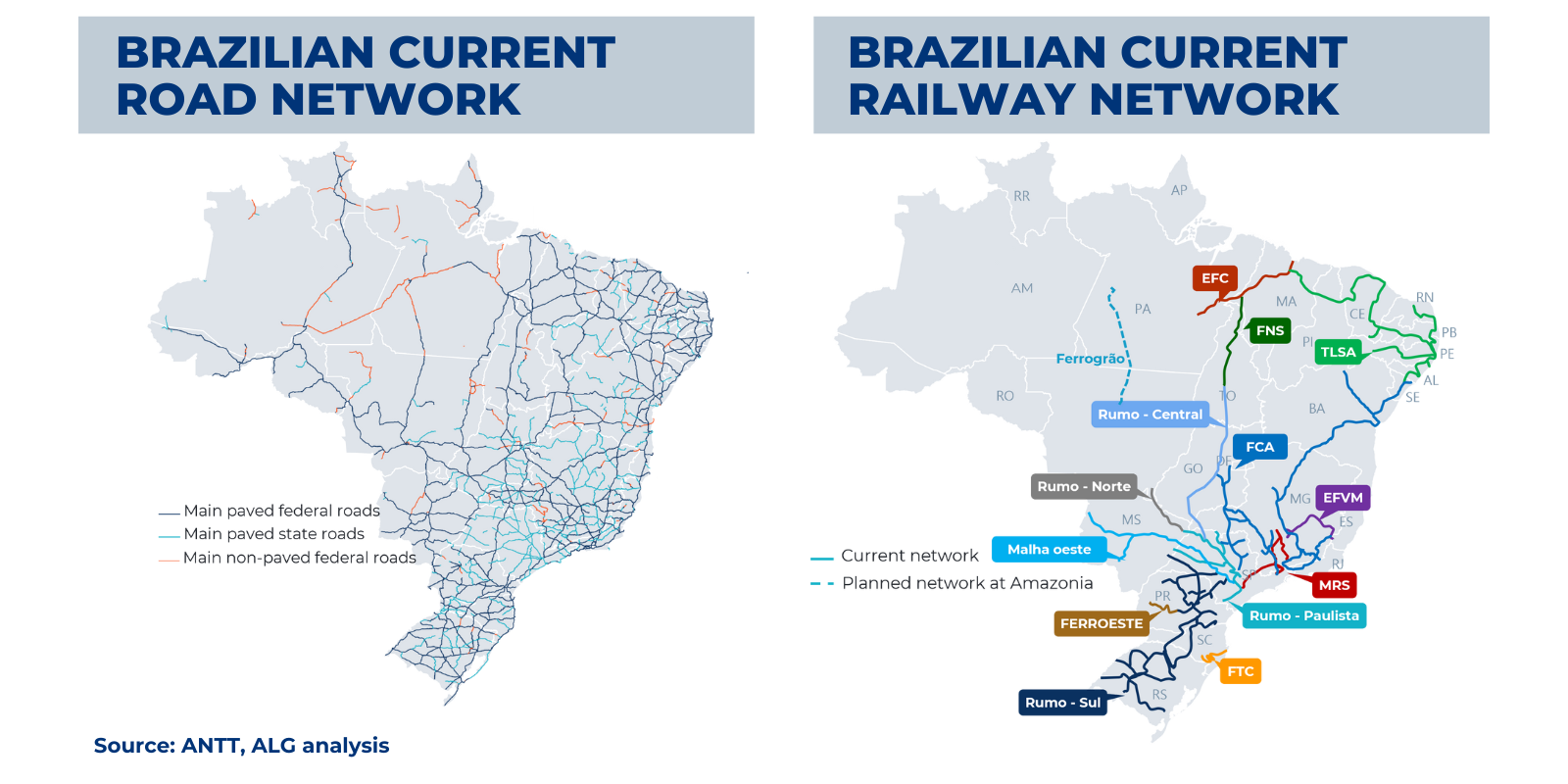

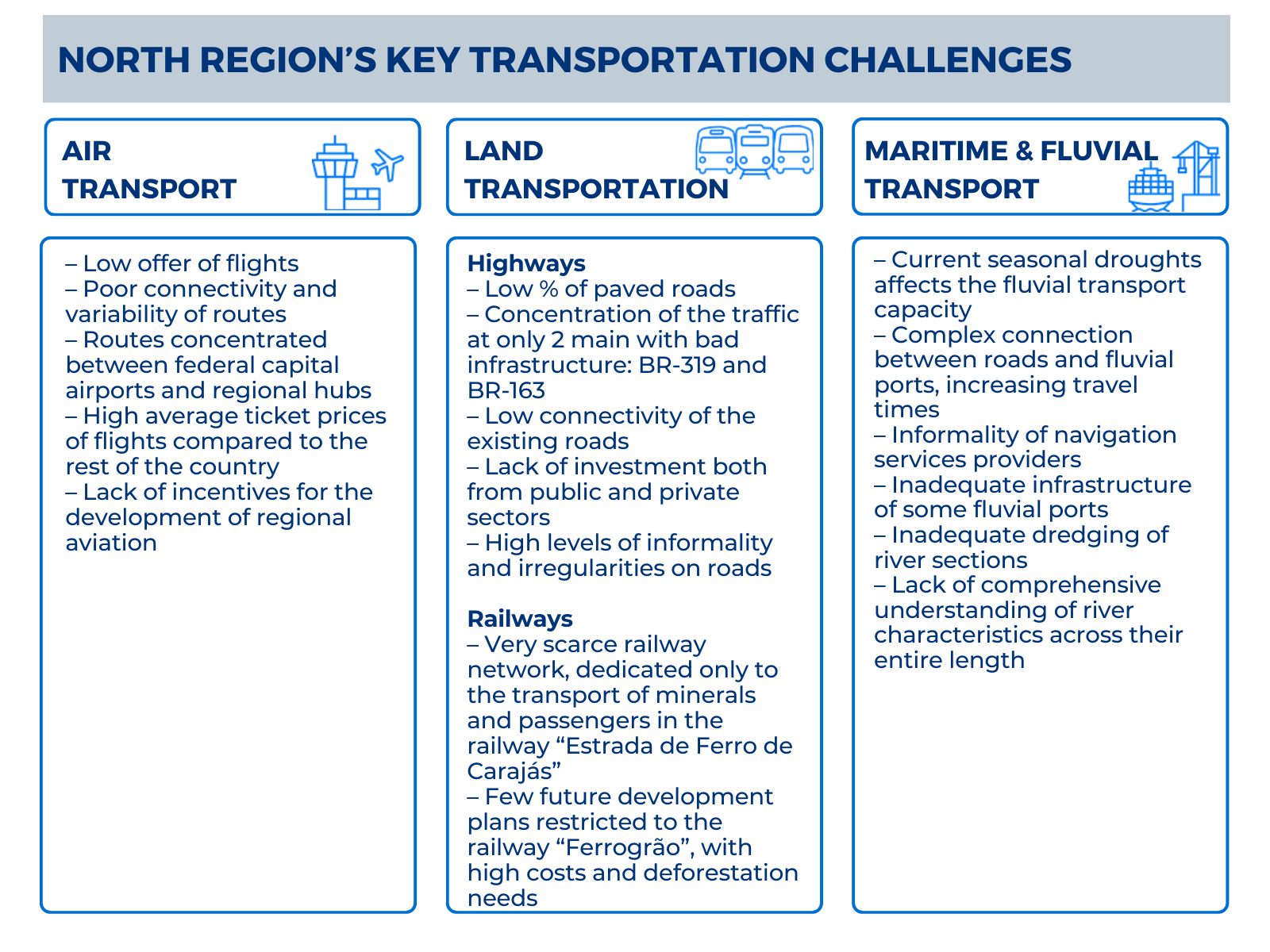

The presence of Amazon rainforest in the North Region together with the lack of investments and linked deforestation issues have hindered the development of land transportation, the main bottleneck to the logistics chain of the region nowadays. Therefore, there is a clear disconnection of Amazon with the rest of the country, with a lower density of highways and railways in comparison to the other regions.

The railway “Estrada de Ferro Carajás (EFC)” is the only concession of a railway asset with an important operation in the Amazon region connecting the mine directly to the port of São Luiz, moving around 7 billion TKUs in 2021 (mainly iron ore and other minerals), also with regular passenger operations. However, its extension of 892 km represents only ~3% of the total Brazilian network, being restricted to operations and interest of the mining company VALE.

The future railway development plans in the Amazon region are restricted to “Ferrogrão”, whose environmental issues and high investments needs hinder its construction in the short term. Such poor connectivity makes the freight transportation heavily dependent on the Amazon’s river and road networks.

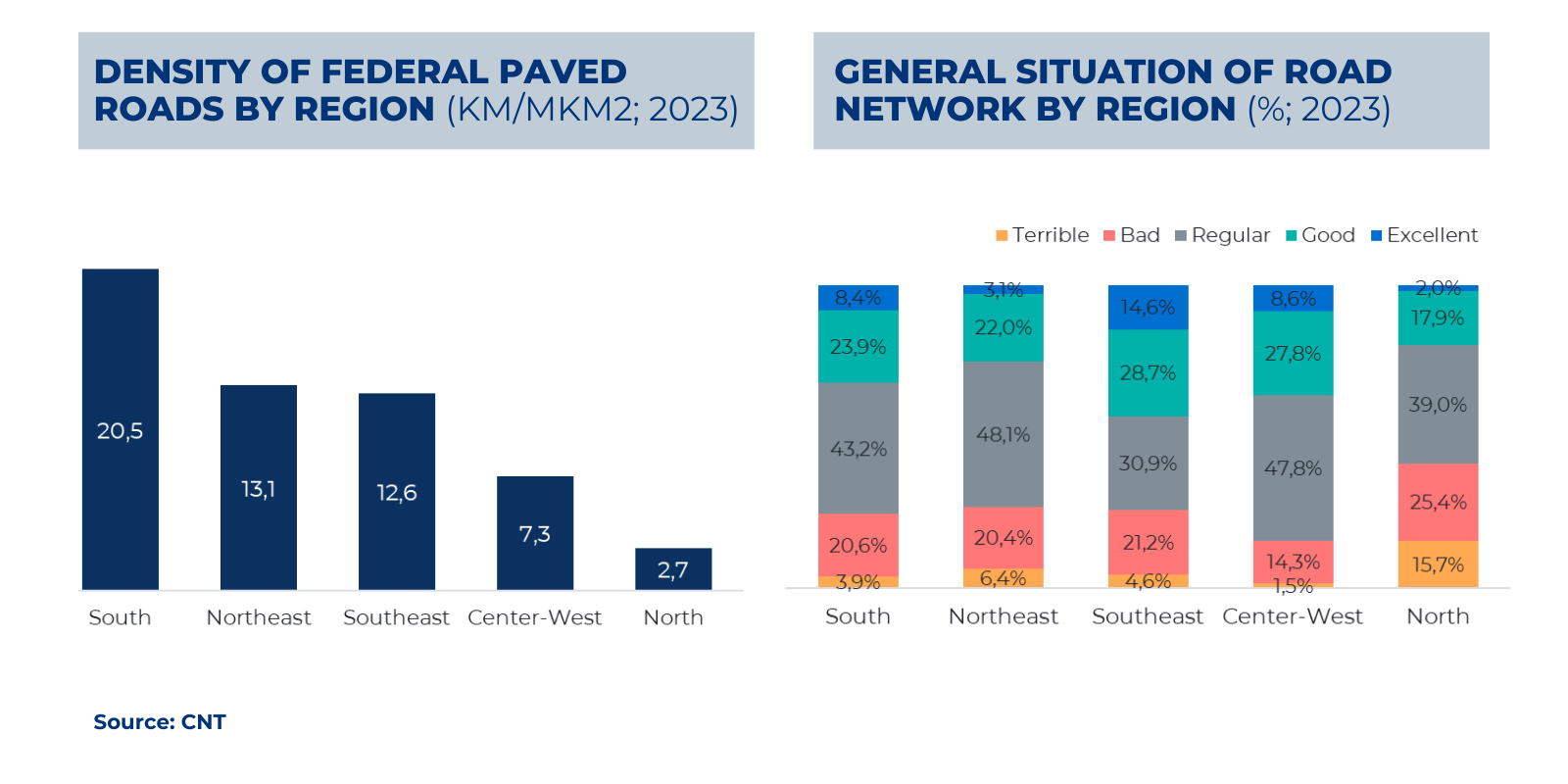

Although the road infrastructure is extensively used in the transportation of grains, especially soy and corn, it is far from being in the proper conditions. The North Region presents very poor connectivity, with the lower extension of paved roads in the country (9.890 km ~15,1% of the total paved network) and the lower density of roads by area, with only 2,7 km/Mkm². Besides, according to the survey carried out by the National Transport Confederation (CNT), the region presented the worst general situation of the country, with ~41% of the roads considered terrible or bad. This low-quality affect significantly the grains transportation, which reached ~46,2 Mton in 2022, once the two main roads of access to the Northern arch corridor, BR-319 and BR-163, features long unpaved sections.

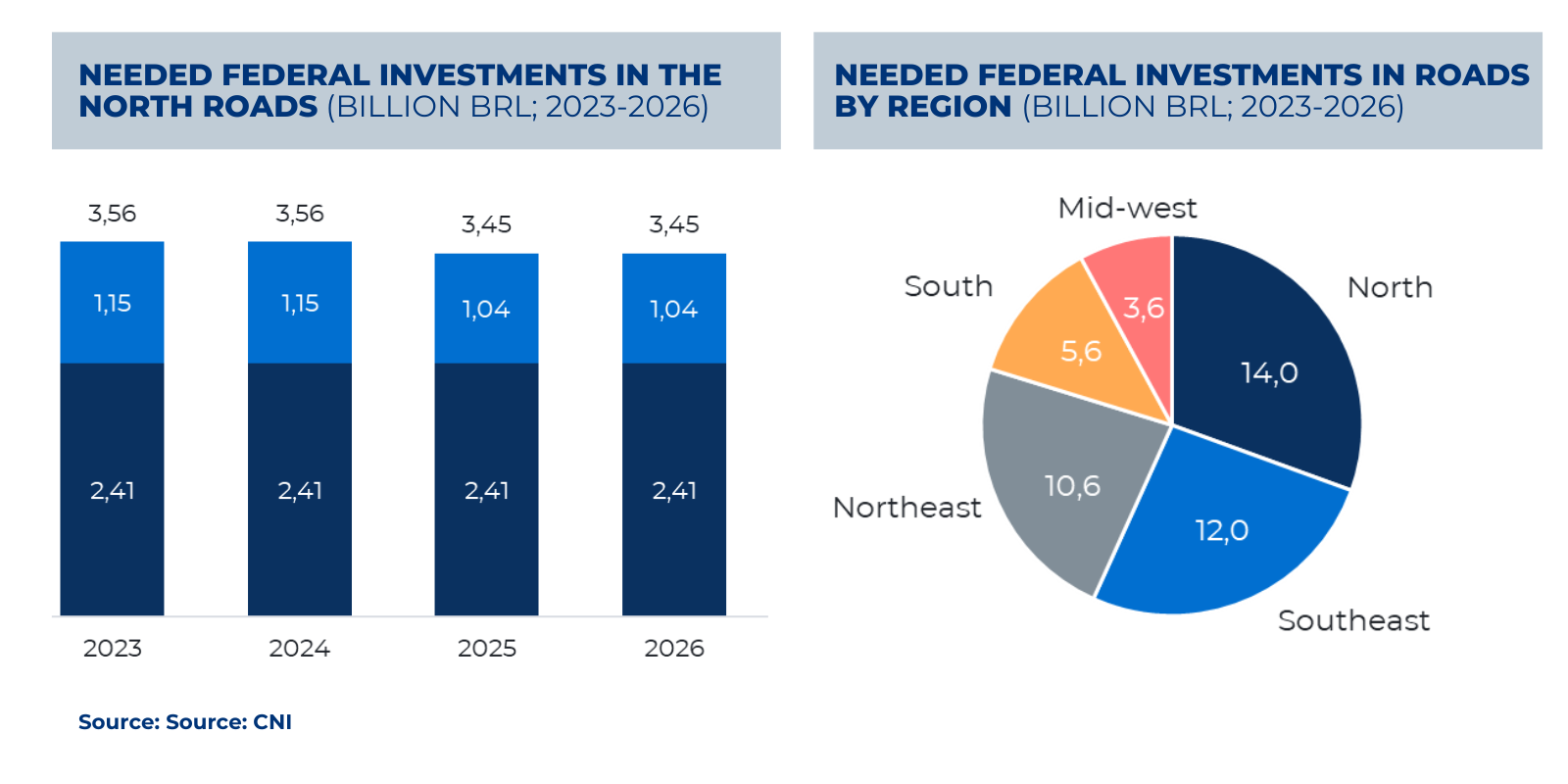

Given the significant inadequacy of the highway infrastructure in the region and its consequent logistics bottlenecks, a study carried out by the Industry National Confederation (CNI) estimates that the North region requires the higher federal investments to reach a satisfactory level of infrastructure quality, with ~14 billion BRL among 2023-2026.

Maritime and river transportation

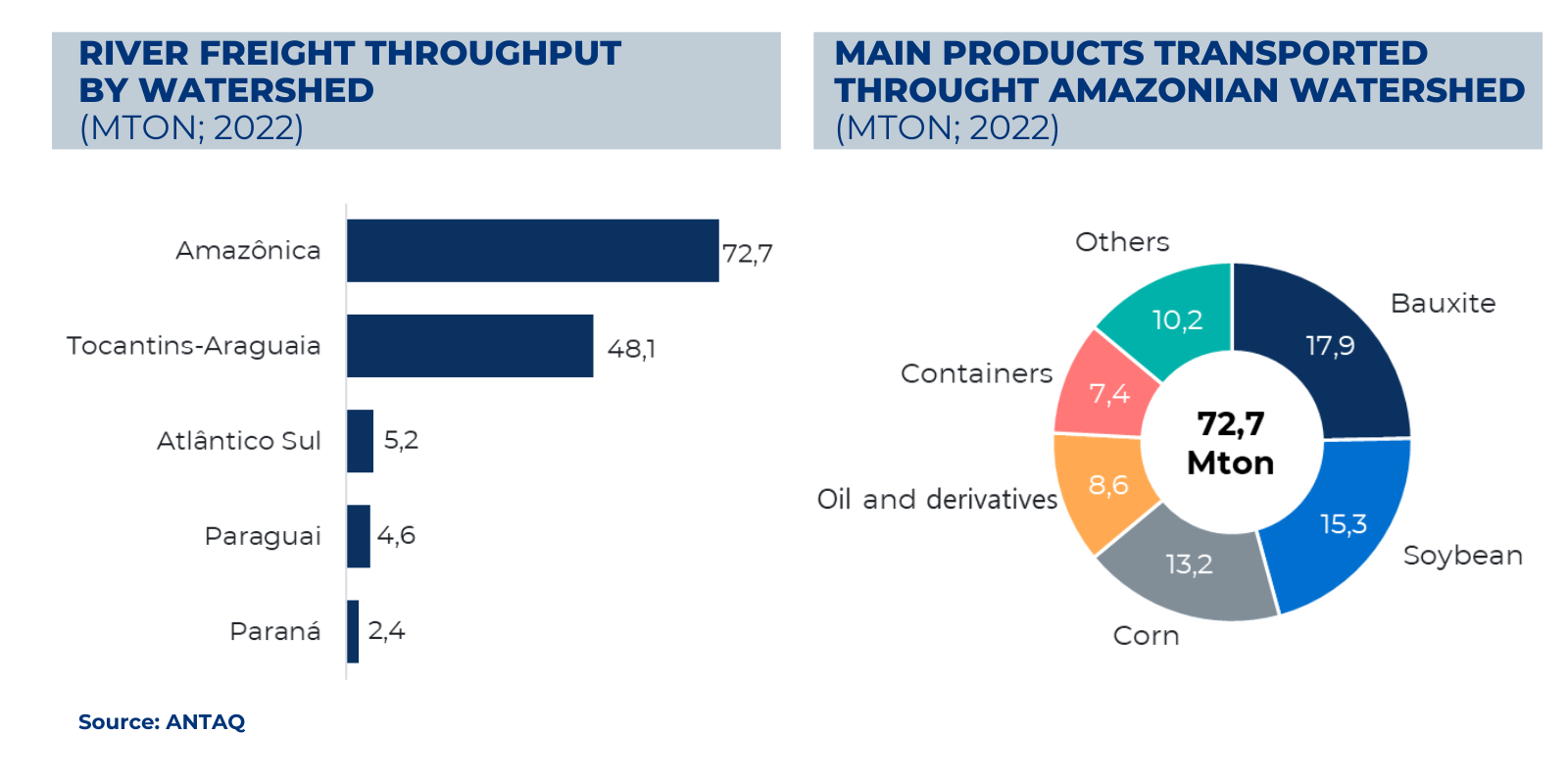

The North region of Brazil boasts some of the world's largest rivers, characterized by their immense water volume and numerous affluents, composing the Northern arch corridor: Amazonas, Madeira, Tapajós, etc. This rich river network presents tremendous potential for both freight and passenger transportation, which is key for the connectivity of the Amazonian communities and general supply chain. In 2022, the Amazonian watershed presented the highest throughput of freight with 72,7 Mton, representing 55% of the whole country throughput through internal waterways.

Given this importance, is the current transport through waterways efficient? The inadequate general infrastructure of the region’s fluvial ports leads to a prolonged transportation and transhipment of freight, together with the informality of the river navigation services providers, reducing the quality of the services. The overall navigational conditions in the rivers are further hindered by inadequate dredging in certain sections and a lack of comprehensive understanding of river characteristics across its entire length, including aspects like river levels.

Moreover, the climate changes and the recent historical drought periods in Amazonia have cast doubt on the reliability of the intermodal road-river transport. The historical drought of 2023 had a huge impact on the logistics chains of Amazonia, with an estimated reduction of 40 to 50% on the transportation capacity of the rivers and an increase of 20 to 50% in the transport tariffs. The climate event affected the whole region and especially the Manaus Industrial Pole (PIM), both in the supply of raw materials and in the industrial production flow.

Air transport

The air transportation has been used as an alternative mainly for the transport of passengers and high-value cargo attending the PIM at MAO airport (~120 kton in 2019). Despite the historic of inadequate infrastructure, the sector has been developed currently with the governmental airport concession program and its consequent infrastructure improvements, in which the main assets with commercial operations have been granted by Vinci in the 6° round of concessions (North Cluster - airports of Manaus, Porto Velho, Boa Vista, Rio Branco, Tabatinga, Tefé and Cruzeiro do Sul) and by Socicam in the 7° round (North Cluster II – Macapá and Belém)

Despite the good perspectives for the next years, the air transportation on the North region still faces a lot of challenges. As the North region accounts for approximately 5 million passengers (ANAC; 2022), constituting merely 5% of Brazil's total air traffic, airlines operate with limited capacity in the area, resulting in scarce flight options. Consequently, it is hard to attract the airlines’ interest on the opening of new routes once the load factors are not high enough to make the operations feasible, creating an air transport market of few flights, poor connectivity, and higher prices. Therefore, the improvement of the connectivity and the increase on the number of flights, especially in regional aviation, are big challenges and relies on infrastructure improvements, governmental subsidies of routes and incentives.

Conclusions

Overall, the Amazon region is defined by extensive yet limited logistics corridors, offering few alternatives for passenger and freight transportation. Despite the need of investment in all the sectors, the main bottleneck relies on connection of roads and waterways, once the intermodal transport road-waterway is key for the entire logistic chains.

ALG brings to the table extensive experience and deep knowledge of the Brazilian logistics market across various transportation modes, including land transportation, maritime and fluvial transport, aviation, and more. Our team is comprised of seasoned consultants with a wealth of expertise in crafting strategies to tackle logistics bottlenecks, conducting thorough commercial assessments, and executing due diligence within these sectors.

If you are seeking additional insights or exploring potential business opportunities for your company in the Brazilian logistics landscape, we invite you to reach out to us. Our team is ready to provide tailored assistance, leveraging our comprehensive understanding of the market to support your business objectives. Don't hesitate to contact us for a collaborative exploration of how we can contribute to the success of your ventures in the dynamic Brazilian logistics sector.