Ten months after its emergence, COVID-19 is still having a profound impact on the global economy. Governments around the world have opted for several policies to contain the transmission of the virus, leading to a drop in demand for products and services, halt in production, and inevitably a sharp decline in public and private expenditures. Countries within the Middle East are more impacted than others due to the additional effects of the drop of the oil prices that are cornerstone for the government expenditure budget.

As a matter of fact, if the critical infrastructure investments will be continued, but potentially causing delays in the expected delivery dates, the non-critical ongoing investments, such as mega projects (new cities, Special Economic Zones) planned or under development will potentially be stopped due to the new financial priorities of the governments, the decline of foreign direct investment as well as the risk of default for those assets.

In the present article, ALG is presenting an overview of the main mega-project landscape in the region, its views about the set of challenges brought by the COVID-19 to the development of these projects, and the potential opportunities post-crisis despite of the high level of uncertainties.

Overview the regional mega projects landscape

Most of regional economies (Middle East, Red Sea and South Asia) are undergoing fundamental transformations to diversify their economy away from the sectors that they heavily relied upon historically, creating employment opportunities for their young and thus supporting in the education and growth of their people. An opportunity arises for GCC countries to reduce their historic reliance on revenues from fossil fuels and build their non-oil GDP.

In this sense, industry, logistics, and tourism have been identified as the key drivers of the economy diversification and Foreign Direct Investment (FDI). GCC countries are benefiting from their financial ability to invest in enabling infrastructure, their strategic location between three continents, and potential of having cheap feedstock.

As for example, in Saudi Arabia, Vision 2030 aims to reduce the country’s dependence on oil, diversify its economy, and develop infrastructure, recreation and tourism. Abu Dhabi 2030 vision ambition developing resilient infrastructure while Qatar, through its National Vision 2030 is looking for more diversified economy by expanding industries and services and investing in world-class infrastructure.

Project Description Neom Cornerstone of vision 2030 of Saudi Arabia, Neom is new cross-border project planned to incorporate a smart city and a massive industrial and logistics land Objective: To provide differential business environment to the rest of KSA aiming at attiring international companies Total area: 26,500 Km2 Stage: very initial

KAEC

Cornerstone of vision 2030 of Saudi Arabia, Neom is new cross-border project planned to incorporate a smart city and a massive industrial and logistics land Objective: To provide differential business environment to the rest of KSA aiming at attiring international companies Total area: 26,500 Km2 Stage: very initial

KAEC

Initiated in 2005, KAEC is one of the new cities being created in Saudi Arabia in the north of Jeddah Objectives: centred on a new port, the goal of KAEC is to become a global logistics and manufacturing developing sectors including FMCG, plastics, automotive, building materials and pharmaceuticals Total area: 180 Km2 Stage: first stage completed in 2010, second stage ongoing

Duqm SEZ

Initiated in 2005, KAEC is one of the new cities being created in Saudi Arabia in the north of Jeddah Objectives: centred on a new port, the goal of KAEC is to become a global logistics and manufacturing developing sectors including FMCG, plastics, automotive, building materials and pharmaceuticals Total area: 180 Km2 Stage: first stage completed in 2010, second stage ongoing

Duqm SEZ

Duqm SEZ will contain several economic, tourism and service development zones, the most prominent are a multi-purpose port, a regional airport, and tourist, industrial and logistical areas Objectives: to become a new node between Muscat and Salalah and take advantage of its location in the Arabic Gulf and the natural resources of the area Total area: 450 Km2 Stage: initial stage

KIZAD

Duqm SEZ will contain several economic, tourism and service development zones, the most prominent are a multi-purpose port, a regional airport, and tourist, industrial and logistical areas Objectives: to become a new node between Muscat and Salalah and take advantage of its location in the Arabic Gulf and the natural resources of the area Total area: 450 Km2 Stage: initial stage

KIZAD

Unveiled in 2010 and opening in 2012, KIZAD is one planned to be one of the largest free zones in the region Objectives: The KIZAD-Khalifa Port model mimics the existing model of JAFZA-Jebel Ali Port. KIZAD will support the diversification of the Abu Dhabi’s economy, anchor traffic into Khalifa Port, and attract foreign direct investments. Over 15 sectors are envisaged within KIZAD, including aluminium, automotive, food, plastics, and pharmaceuticals Total area: 410 Km2 Stage: first stage completed in 2012

Dubai South

Unveiled in 2010 and opening in 2012, KIZAD is one planned to be one of the largest free zones in the region Objectives: The KIZAD-Khalifa Port model mimics the existing model of JAFZA-Jebel Ali Port. KIZAD will support the diversification of the Abu Dhabi’s economy, anchor traffic into Khalifa Port, and attract foreign direct investments. Over 15 sectors are envisaged within KIZAD, including aluminium, automotive, food, plastics, and pharmaceuticals Total area: 410 Km2 Stage: first stage completed in 2012

Dubai South

Launched in 2006 and located within the vicinity of Dubai World Central, Dubai South aims at leveraging on its strategic location between the port and the airport. Objectives: To support the socioeconomic development of Dubai by creating jobs and empowering businesses. The zone is located next to DWC airport and has a vision for a business park, aviation district, commercial district, logistics district, and a community. Total area: 145 Km2 Stage: The project is still under development

Umm Alhoul and Ras Bufontas FZ

Launched in 2006 and located within the vicinity of Dubai World Central, Dubai South aims at leveraging on its strategic location between the port and the airport. Objectives: To support the socioeconomic development of Dubai by creating jobs and empowering businesses. The zone is located next to DWC airport and has a vision for a business park, aviation district, commercial district, logistics district, and a community. Total area: 145 Km2 Stage: The project is still under development

Umm Alhoul and Ras Bufontas FZ

Initially proposed in 2011, the free zones of Umm Alhoul and Ras Bufontas aim at diversifying the economy of Qatar towards new industries and sectors Objectives: To attract foreign direct investment into Qatar and support he government in achieving its Qatar 2030 objectives such as diversifying the economy away from its reliance on the petrochemical sector. Located near Hamad Port, Umm Alhoul FZ will cater for a vast range of sectors such as food processing, metals, and logistics. Located near Hamad Airport, Ras Bufontas will attract businesses that are driven by the aviation sector such as logistics. Total area: 40 Km2 Stage: The project is still under development

Ain Sokhna Economic Zone

Initially proposed in 2011, the free zones of Umm Alhoul and Ras Bufontas aim at diversifying the economy of Qatar towards new industries and sectors Objectives: To attract foreign direct investment into Qatar and support he government in achieving its Qatar 2030 objectives such as diversifying the economy away from its reliance on the petrochemical sector. Located near Hamad Port, Umm Alhoul FZ will cater for a vast range of sectors such as food processing, metals, and logistics. Located near Hamad Airport, Ras Bufontas will attract businesses that are driven by the aviation sector such as logistics. Total area: 40 Km2 Stage: The project is still under development

Ain Sokhna Economic Zone

Located along the international trade route, Ain Sokhna Economic Zone will support the local economy Objectives: To develop the trade within Suez Canal and ensure a wider socioeconomic development within Egypt. Apart from the existing industries (metal processing, ceramics, etc.), the special economic zone will attract new industries such as spare parts for automobile, chemicals, pharmaceutical, etc. Total area: 163 Km2 Stage: The project is still under development

East Port Said

Located along the international trade route, Ain Sokhna Economic Zone will support the local economy Objectives: To develop the trade within Suez Canal and ensure a wider socioeconomic development within Egypt. Apart from the existing industries (metal processing, ceramics, etc.), the special economic zone will attract new industries such as spare parts for automobile, chemicals, pharmaceutical, etc. Total area: 163 Km2 Stage: The project is still under development

East Port Said

Currently being developed into a major transhipment center with a multi-modal logistics centre with planned and existing urban communities in the immediate vicinity. The project will include medium and light industries as well as commercial activities.

Colombo SEZ

Currently being developed into a major transhipment center with a multi-modal logistics centre with planned and existing urban communities in the immediate vicinity. The project will include medium and light industries as well as commercial activities.

Colombo SEZ

Initiated in 2014, the Colombo Port City is a project initiated by Chinese investments and the government of Sri Lanka. The SEZ will have an important role in the development of service sectors (financial, telecom, etc.) of Sri Lanka. Objectives: As part of a brand-new city that is near the port of Colombo, the special economic zone will support trade in South Asia and will support the development of the new city. Total area: 3 Km2 Stage: The project is still under development

Djibouti International FTZ

Initiated in 2014, the Colombo Port City is a project initiated by Chinese investments and the government of Sri Lanka. The SEZ will have an important role in the development of service sectors (financial, telecom, etc.) of Sri Lanka. Objectives: As part of a brand-new city that is near the port of Colombo, the special economic zone will support trade in South Asia and will support the development of the new city. Total area: 3 Km2 Stage: The project is still under development

Djibouti International FTZ

Inaugurated in 2018, DIFTZ is set to be the largest free trade zone in Africa. The free zone is located adjacent to Djibouti’s main ports. Objectives: The project will create opportunities within Djibouti to develop industries such as manufacturing and will increase the processing capacity. The sectors identified are food, automotive parts, textiles, and packaging. Total area: 3 Km2 in the initial phase. Stage: The project is still under development

Inaugurated in 2018, DIFTZ is set to be the largest free trade zone in Africa. The free zone is located adjacent to Djibouti’s main ports. Objectives: The project will create opportunities within Djibouti to develop industries such as manufacturing and will increase the processing capacity. The sectors identified are food, automotive parts, textiles, and packaging. Total area: 3 Km2 in the initial phase. Stage: The project is still under development

Overview of Mega projects in the region

The mega projects typically require more than1 Bn USD of capital investments. The most common practices of allocating the funds:

- The governments allocate and approve a budget for these projects:

- The governments undertake public expenditures for projects that are vital for the development of the community and that have large socio-economic impact. In addition to that, projects that are not financially viable for the private sector are typically initiated by the public sector for the projects’ positive effect on the society

- The local private sector participates in public private partnership:

- Seeking maximum financial return, the private sector will ensure that the project is completed in the most efficient and effective manner. The private sector has also the know-how of similar projects.

- Foreign direct investments (FDI):

- Certain countries such as China have global perspective to ensure financial sustainability of their own economies by investing in high-impact projects around the world and particularly in the Middle East, especially after the launch of the Belt and Road Initiative.

Challenges exerted by Covid-19 The economic shock brought by the coronavirus was compared to that of the financial crisis of 2009. Governments have developed policies to counter the upcoming downturn. Governments and countries have imposed strict regulations to minimize the spread of the virus, resulting in the stoppage of various sectors. This impacted the household income, transport, travel, labor supply, etc. Complex sectors, such as automotive manufacturing, are more affected by the virus due to trade restrictions than other less complex sectors. Estimating the trade recovery in the upcoming years is highly dependent on the duration of the virus spread and the success of the policies.

Due to COVID-19, the private sector is now facing a greater risk on new investments due to the increased uncertainty and reduced demand and thus investors are not keen on undertaking large capital investments especially mega-infrastructure projects.

Moreover, government expenditure within the Middle East has decreased due to the impact of COVID-19 had on the global economy and thus on the crude prices. Uncertainty is still present in regards to when crude prices are expected to recover. Countries such as the Kingdom of Saudi Arabia have reviewed their spending plan for 2020 and 2021 and have taken additional measures to reduce the budget deficit such as raising the taxes. Thus, those governments have categorized the projects in the pipeline into level of importance and has postponed the implementation of those investments/ projects that are do not have a large ratio of value added to the investments performed. Governments have redirected the short-term budget towards developing the healthcare system (by developing field centers, by upgrading hospitals, etc.) and other vital sectors. The existing projects that are under development have been put on hold. And the completion has been delayed.

The world’s inward flows of the foreign direct investment were growing exponentially between 2001 and 2007 at a double-digit rate to reach 1.9 Tn USD. World’s FDI decreased to 1.2 Tn USD by 2009 (-37% from its all-time high) as an aftermath of the global financial crisis. Since 2010, the annual FDI fluctuated between 1.4 Tn USD and 2.0 Tn USD and followed a linear trend of +0.3% CAGR.

World foreign direct investment evolution (Tn USD)

If COVID-19 had not hit, the world foreign direct investment would have gained momentum. ALG believes that the FDI will decrease in 2020 and in 2021 as a consequence of the current pandemic.

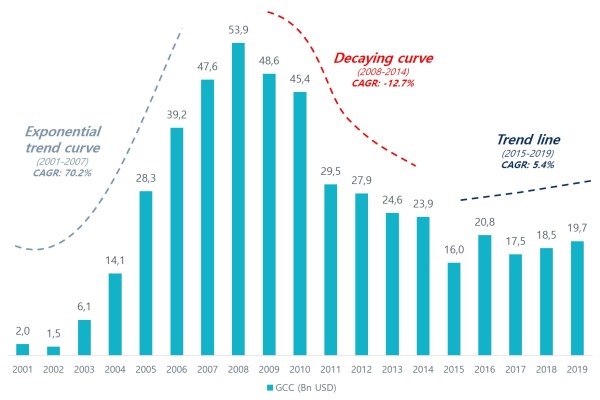

As new mega-projects have begun to surface in the GCC (mainly UAE through Dubai) in the early 2000s, the interest of the international community grew to invest in those projects. Foreign direct investment in the GCC grew at 70% CAGR from 2.0 Bn USD in 2001 to 47.6 Bn USD in 2007. Once the financial crisis hit the region early 2009, many projects such as Nakheel’s Palm Jumeirah where put on hold for refinancing while others where scrapped such as Palm Deira project. FDI gradually decreased at -12.1% CAGR as the hype faded. For the past 5 years, the foreign direct investments have grown at 5.4% CAGR.

Evolution of inward Foreign direct investment flows in GCC (Bn USD)

Due to COVID-19, we can expect that the foreign direct investment into GCC will drop in the upcoming short term and the infrastructure financing will take a downward plunge before rebounding due to new regional developments.

Way forward

As the COVID-19 pandemic will impact both the short term and the long-term demand for commodities, alter behavior of individuals (e.g. customer spending index, etc.), and create new industry trends, existing and new projects should be looked into via a new perspective.

It is important for the private sector to achieve adequate financial return on a certain project. For example, if the new container traffic at a port is severely impacted due to COVID-19, the project will not be as financially viable as if it were with pre-COVID traffic conditions. The way forward would be agreeing with the authority on new contract/concession conditions. The revenue share percentage could be reduced or the committed capital investments can be reduced/ looked into. It is important to set clauses within the new concessions to account for Force Majeure.

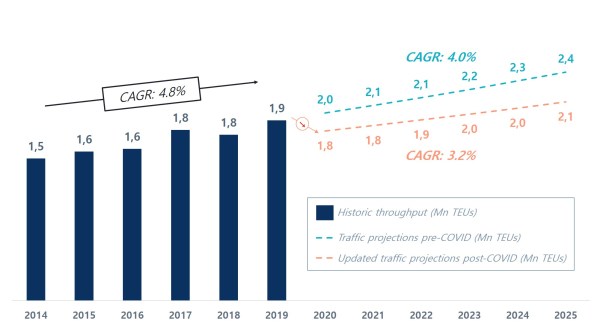

The future traffic projections will change due to COVID-19 pandemic. The container traffic at Jebel Ali Port grew at an exponential rate of 19.0% CAGR from 2001 to 2008. The total traffic at Jebel Ali Port drop -6% yoy After the financial crisis in 2008, the traffic grew at a slower rate of 2.4% CAGR until 2018.

Evolution of container traffic in Jebel Ali Port (Mn TEU)

In a wholistic perspective, COVID-19 will have a similar effect as the on the container traffic, both in terms of the drop in volumes due to reduced demand and on the grow rate due to the impact of COVID-19 on the society in the mid-term and long-term perspective. The degree of which the impact of COVID-19 is felt on the maritime sector will vary depending on:

- The duration of the pandemic, impacting the shape of the recovery

- The location of the port and the type of commodities handled by the port (goods with lower complexities vs goods with higher complexities, etc.)

- The type of cargo (origin/destination vs transshipment, etc.)

Case study on the impact of Covid-19 on terminal traffic (Mn TEUs)

An illustrative example is presented above. A PPP transaction has been closed by the port authority and the Operator in 2019. As part of the negotiation process, the authority and the operator performed a market study and had agreed on the future traffic estimates at the port. In addition to that, the parties have agreed on the contract revenue share model. The revenue share model is devised to ensure that it is financially feasible for the operator and is a win-win deal for the two parties. Due to the impact of COVID-19 on the local and global landscape, the traffic projections of that port will likely drop and the traffic projections will not grow at the same rate as previously forecasted. The revenue of the operator, driven by the traffic throughput, will decrease throughout the concession, making the concession less profitable for the operator. By having clauses that protect the concessionaire from those unforeseen events, the operator can demand for the adjustment of the contract terms such as:

- Reduction of the revenue share scheme

- Postponement of the capital investments

- Tariffs

Reinvigorate infrastructure funding and attract FDIs

With reduced budgets due to COVID-19, the public sector has to undertake a wholistic approach on all the projects in hand. The projects’ scope of work needs to be updated. By ranking the projects from a cost-benefit analysis and by considering the socio-economic impact of those projects, the public sector can start the re-launching the projects gradually. The projects need to be analyzed with new perspective and consider the option of getting on board the private sector via PPP schemes with more alignment of private and public sector interests. Greater collaboration will deliver improved outcomes for investors and realize the socio-economic benefits that new mega project brings.

Also, governments should adjust the foreign investment policy. The challenge is as much about governance and facilitation as it financial. Policymakers need to create an environment that gives greater certainty over timelines and delivery projects, and make procurement processes more efficient. An international high-level structure and format for classifying, defining, measuring, recording, analyzing and presenting construction and other life cycle costs of infrastructure assets can help promote reliable early cost estimates, benchmarking at the asset, system, and network level, and bring in transparency during design, construction, and operation.

As summary of recommendations to reinvigorate Mega-project development post-covid-19:

- Taking advantage of the current crisis as a catalyst to rethink how infrastructure assets and investments should be structured.

- Developing more integrated decision-making systems between Private and Public sectors with a better aligning infrastructure project timeline with investor profiles and time horizons.

- Projects re-evaluation in terms of projected flows, components and infrastructure requirements.

- Contracts review with consideration given to incorporating certain key clauses (force majeure clause, aspens clause) to mitigate against risks caused by unforeseen circumstances in the future.

- Embracing digitalization in development and construction of infrastructure projects to realize operational savings and deliver more efficient asset management.