In recent years, toll pricing has gained prominence as a strategic instrument in transport economics. While originally designed to recover infrastructure investment costs, tolls have evolved into a versatile policy tool for managing congestion, pollution, and excessive road use. By linking a direct fee to a specific facility, policymakers and operators can shape travel behaviour while securing a sustainable revenue stream.

For private operators investing in toll concessions, accurately forecasting traffic over the asset’s lifetime is critical. These forecasts hinge on projected socioeconomic growth, characteristics of the catchment area, competing routes, user profiles, but—most importantly—the toll price itself. Understanding how traffic responds to toll changes is essential not only for financial and traffic modelling but also for assessing long-term operational performance.

The concept of price elasticity captures this relationship: it represents the percentage change in traffic volume resulting from a one-percent change in the toll price. In other words, it reflects how sensitive users are to changes in the cost of using a road. This parameter is typically estimated empirically. This can involve historical data or econometric models that observe past toll adjustments and their associated impact on traffic. However, a major source of elasticity estimates comes from field surveys, including both stated preference and revealed preference studies, which provide a direct window into user behavior.

The sector often relies on static elasticity benchmarks from various toll road studies to anticipate traffic response to toll adjustments. These benchmarks are usually differentiated by vehicle type—passenger cars, heavy trucks, or buses. International studies suggest that elasticity for private vehicles generally ranges from -0.1 to -0.3, with heavy vehicles being typically less sensitive.

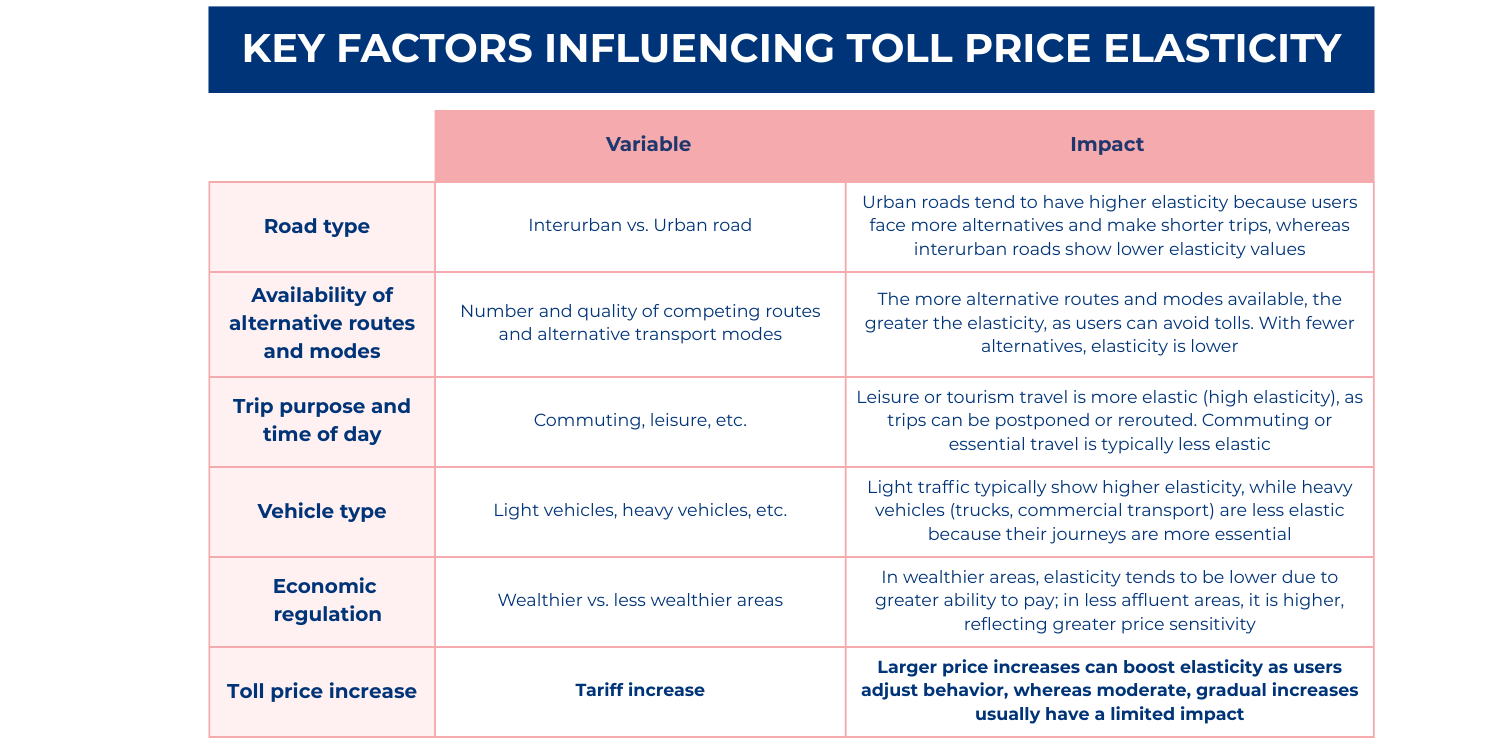

However, far from being a static concept, elasticity values can fluctuate significantly depending on a range of factors, influencing how traffic responds to toll changes:

How can price changes significantly impact the value of toll elasticity

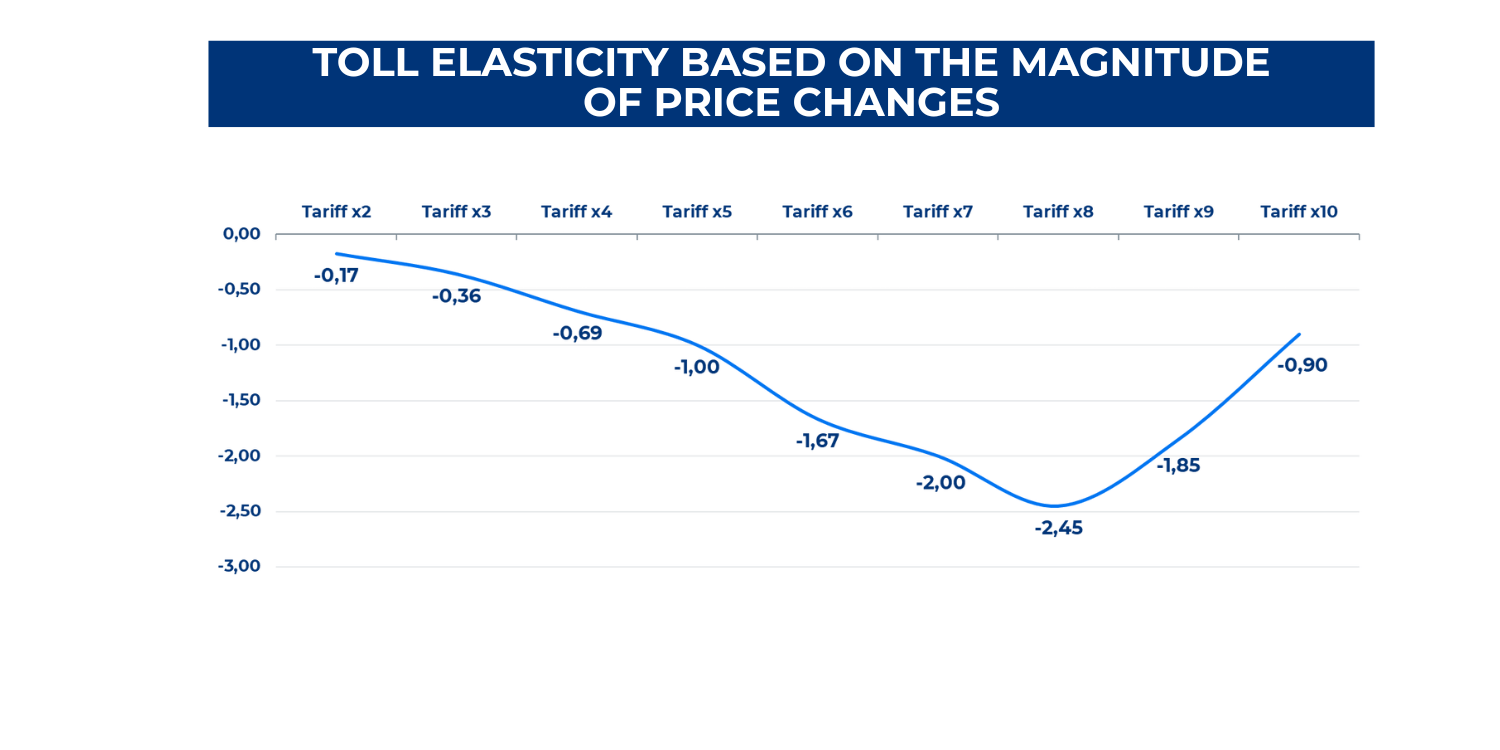

The sector is increasingly recognizing that the price elasticity of toll demand is not static—it is dynamic, evolving with the magnitude of toll changes. Based on ALG’s experience and insights from multiple toll road projects, user sensitivity clearly shifts as toll levels rise.

At low increments, demand responds only mildly: most travellers can absorb small increases, resulting in limited elasticity. As tolls continue to climb, elasticity grows, with more users altering travel patterns—switching routes, reducing trip frequency, or even avoiding the tolled facility entirely.

Interestingly, this trend does not continue indefinitely. Once tolls reach high levels, the elasticity curve flattens and eventually declines in absolute value. The remaining users—often higher-income, with higher values of time—are inherently less price-sensitive, making aggregate demand more inelastic despite further tariff increases.

This pattern—low elasticity, steep rise, then flattening—illustrates the nonlinear and heterogeneous nature of toll elasticity.

Understanding this dynamic response is critical for forecasting traffic and evaluating toll policies. Relying solely on static elasticity risks misjudging revenue impacts: overly aggressive increases may reduce traffic and revenue more than expected, while missed opportunities arise where demand could support moderate price adjustments.

Operators who account for the dynamic, user- and case-specific nature of elasticity gain a strategic advantage, aligning pricing with actual behavior across the full range of toll scenarios.

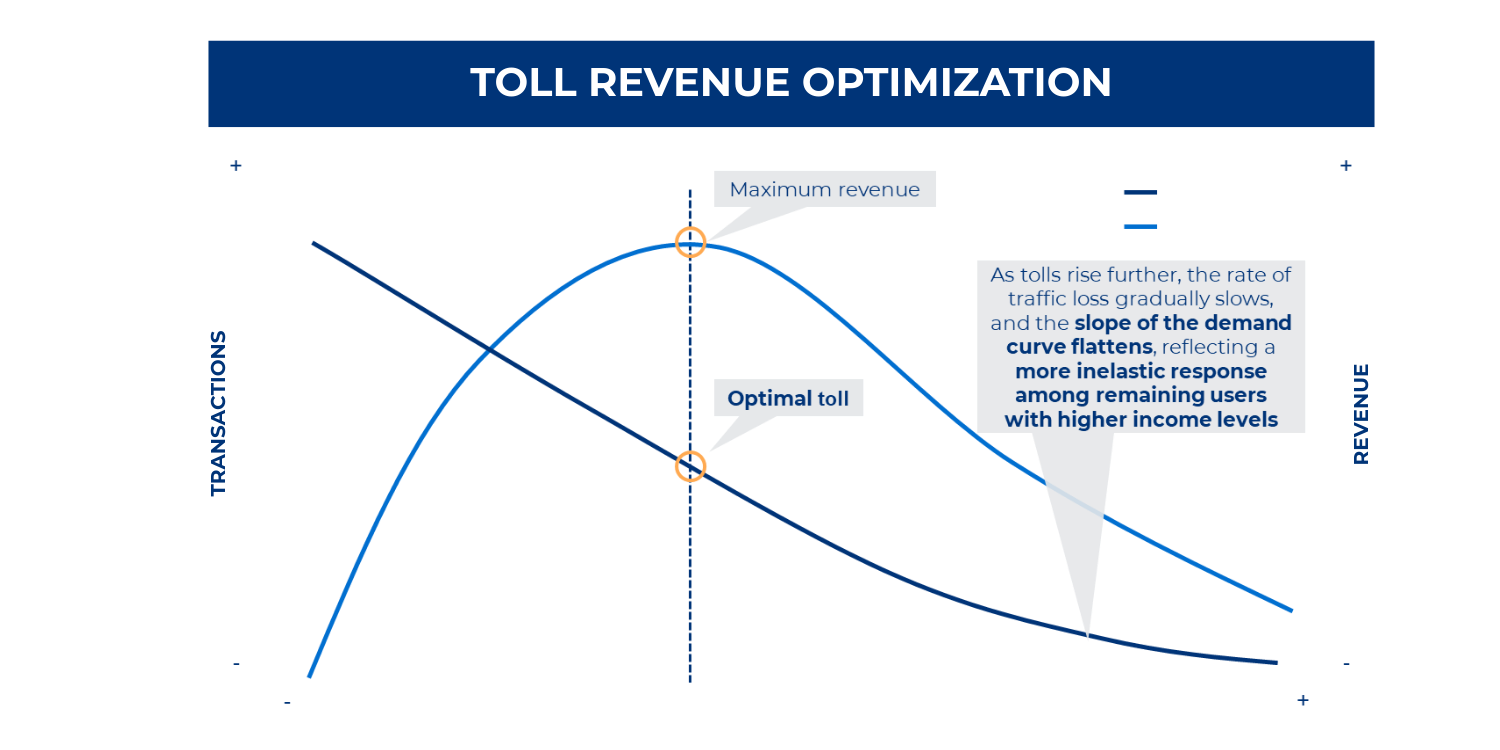

By accounting for how elasticity changes with price, toll road operators can better identify optimal tariffs that balance traffic and revenue. Simply put, the goal is to find the point where higher tolls increase income without driving away too many users.

At moderate toll levels, most drivers continue using the road, so revenue rises even if traffic dips slightly. As prices climb further, more users start seeking alternatives, and traffic declines become more pronounced.

Over time, however, the rate of traffic loss slows. The remaining users—often higher-income drivers or those with higher values of time—are less sensitive to further toll increases. This makes overall demand more inelastic, so each additional price hike has a smaller impact on traffic. So even in cases of extreme toll increases, a small group of wealthy users tends to remain reluctant to abandon the toll road, sustaining a residual level of traffic.