Temperature Controlled Logistics (TCL) is still a very under-developed market in Latin America. The waste ratio (i.e. the cargo lost due to the lack of proper logistics) is currently around 15-20%, while informal logistics exceed 30%, which affects the quality of the product. Logistics costs are significantly higher than in most developed regions (12% of GDP vs 8% in Europe and North America).

This lower specialisation due to more limited penetration of TCL operators is caused by several factors, including: limited transport infrastructure, outdated warehouses and an ageing fleet, high investment requirements, lack of integration among stakeholders, lack of specialised human resources, atomisation of transport companies, small to medium local players with low bargaining power, and the seasonality of some cargoes.

With an overall regional TCL market in excess of 350 Mn Tn of fruit and vegetables, meat, fish, dairy and pharma products, more and more players are showing interest in these niche markets. The appetite is even larger as a result of the positive outlook for the industry: growth of local production and imports, increase in formality, higher share of processed foods and increases in outsourced logistics.

Objectives, goals and purposes

The aim of the study was to provide a comprehensive market study of TCL sectors to identify the existing suppliers, key constraints, drivers of growth and potential opportunities for private investment. Closing this knowledge gap can help determine whether and how private investment opportunities can be structured and implemented to help develop these sectors.

Study methodology and activities

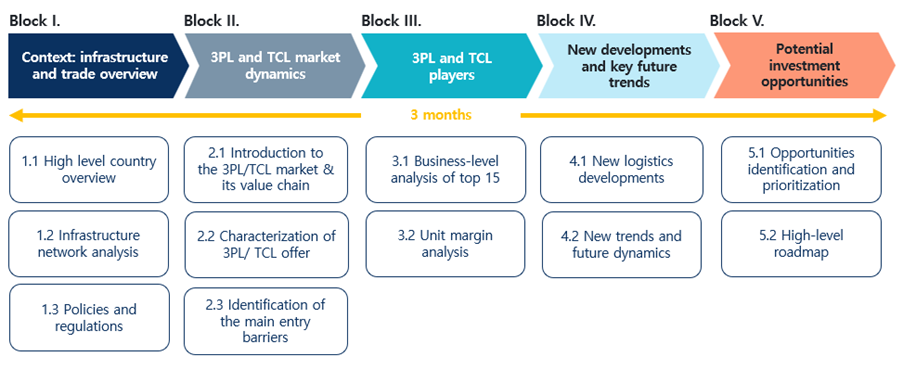

ALG divided the project into five main blocks:

- Context: Infrastructure, trade and industry overview

● High-level country overview: contextual understanding of the logistics issues in each country through summary macroeconomic analysis of each country. Identification of the current key strategies and plans of the governments for development of their logistics networks (specifically in relation to the 3PL and TCL sectors).

● Infrastructure network analysis: description of existing infrastructure by mode and identification of the main trade, intermodal and logistics nodes/hubs, analysing current gaps and bottlenecks for each sector cluster/industry.

● Policies and regulations: understanding the country’s regulations framework for logistics and the sector, identifying the main institutions, players and companies involved, and sketching out the options for private investment in the sector. - 3PL/TCL market dynamics

● Introduction to the 3PL/TCL market and its value chain: description of the main 3PL/TCL activities and their role in the value chain, identifying and describing the subsectors involved ; identification of the main growth drivers and trends; and understanding the weight of each segment in the whole chain in terms of costs (transportation, warehousing, freight, etc.).

● Description of 3PL/TCL capacity: assessment of the overall 3PL/TCL capacity at the country level and identification of the largest suppliers, as well as the top users for each subsector.

● Identification of the main barriers to entry for global, regional and national players, considering policies and regulation affecting new entrants to the market, economies of scale and other cost barriers, strategic locations, technological advantages and knowhow, capital (high fixed costs) and exit barriers. - 3PL and TCL players

● Business-level analysis of the top 15 players: identification and description of the top 15 players in current operations, describing the main industries and clients, the market share of the companies and their strategy, growth and expansion plans, and identifying major local, regional and international competitors.

● Unit margin analysis: analysis of the main financials for the top 15 players and their major costs. - New developments and key future trends

● New logistics developments: overview of future capacity and potential changes in trade and supply dynamics.

● New trends and future dynamics: description of new trends and identification of potential future gaps. - Potential investment opportunities

● Identification and prioritisation of opportunities: identification of operating inefficiencies and capacity-related bottlenecks within the value chain, and assessment of the top players’ investment plans to identify the best investment opportunities for our client, IFC, based on a high-level profit/risk matrix.

● Roadmap: proposal of a high-level implementation roadmap, defining the next steps and main potential bottlenecks and implementation risks.

Success and outcomes

As a result of this preliminary study, IFC identified at least one interesting investment or financing opportunity, which is currently being negotiated, with ALG providing commercial and technical due diligence.