ALG was appointed by the Transport General Authority (TGA) to provide a technical assessment of the liberalisation of the intercity bus market in the Kingdom of Saudi Arabia (KSA). The current network has been operated by SAPTCO since 1978. It is run as a subsidised intercity bus monopoly concession.

There are more than 200 intercity routes, with an average journey length of 10 hours and around 5 million passengers transported annually. The liberalisation project for the intercity bus market aims to develop intercity bus services by attracting qualified and efficient operators, to provide high quality, safe, reliable, punctual and affordable services while improving integration with other forms of transport.

The main objectives of the liberalisation process include:

- Improve service quality, providing high quality, safe, reliable, punctual and affordable services that are integrated with other transport modes.

- Enable competition and encourage private-sector innovation.

- Increase the number of passengers and maintain the share of bus transportation usage.

- Smooth the transition between the current and new operators.

- Deregulation of the market in the long term, contingent on the emergence of a competitive and professional market for operators.

Objectives, goals and purposes

The objective of the project was to define the network and concessions, launch the bid, support the tendering process, and help the new operators in the transition and startup of operations.

Study methodology and activities

The scope of work includes reviewing the current situation, developing the service specifications, and defining the new concession agreements, KPIs and tender documents.

Assessment of the current situation:

- Data collection and review to provide a robust estimate of the intercity bus market in KSA, while identifying potential gaps.

- Competitive analysis against alternative modes of transport.

- Market testing and meetings with potential operators.

- Network definition and building a new Intercity Bus Model.

Service specifications and basis of operation:

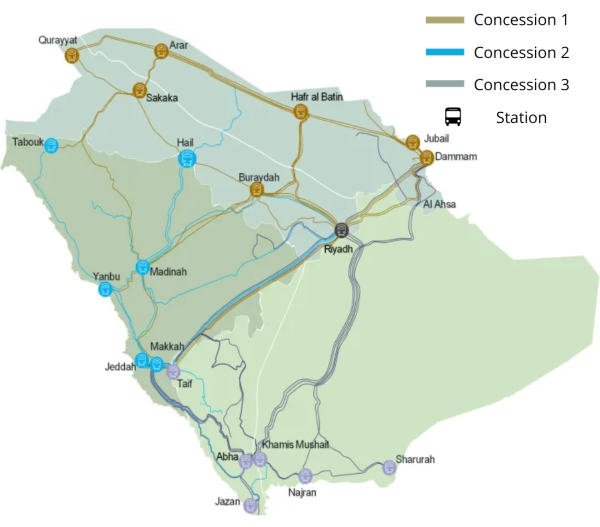

- In-depth design of the new intercity bus network (concession boundaries, services, routes, stops, frequencies, GIS map, etc).

- Demand forecasting for the entire network.

- Route bundling strategy and concession definition.

- Development of the financial model and business plan for each concession area.

- Definition of service specifications and identification of KPIs.

New concession agreement and tendering documents:

- Development of all tender documents (RfP, EoI, financial and contractual requirements, etc).

- Establish evaluation criteria for selecting the preferred bidder.

- Support TGA during the tendering process and award: communication with interested parties to invite bids, Q&As, workshops, clarifications, etc.

- Transition stage and programme close-out to ensure service continuity and mobilisation of operators in each concession area.

Key findings and recommendations

As the project advances towards award of the contract, the key lessons learned have been compiled considering various aspects of the project. While the desired outcome will be highly dependent on successful implementation of the project, the main takeaways include:

- Project scope: definition of the concession areas and network requirements is highly dependent on the attractiveness of the market and demand opportunities. While using the country’s objectives as the main strategic guide, a balanced approach is needed between service levels and the economics of the project to define the project scope correctly.

- Concession configuration: various options are possible to balance government and private-sector participation. While direct and gross cost contracts are preferred in urban concessions, due to higher service level requirements (such as punctuality and maximum fares), net cost contracts can meet the government’s objectives for private-sector participation.

- Additional opportunities: there are several business and operational opportunities for operators to explore. These opportunities are maximised in the proposed net-cost-contract approach, as this gives operators the largest incentive to invest in further revenue generation, due to the greater operational freedom and absence of minimum revenue guarantees.

Success and outcomes

The tender process was a success given the large number of bidders, with consortiums comprising high-quality international and local operators. The quality of the bids submitted was very high.

The project is currently in the award process, after which the transition period will begin. It is expected that the three new operators of the intercity bus service will provide high service quality. This will attract demand, including new market segments.