ALG was commissioned by a global port operator to assist in verifying the feasibility of a potential investment in the US container market. This project consisted of commercial due diligence for two container terminals for the Port of New York and New Jersey.

North America has been and remains one the world’s strongest economic regions.

Maritime container trade has grown prolifically since the turn of the century, with Atlantic and Gulf ports gaining market share at the expense of ports in the South Pacific since 2003. Due to their locations and hinterland, ports such as Savannah and NY have been able to take advantage of this shift. Our client’s main objective was to understand whether this growth will be sustainable in the future.

Objectives, goals and purposes

The objective of the project was to present the client with a comprehensive market study for the US container market, placing particular emphasis on the East Coast and the competitiveness of the two container terminals.

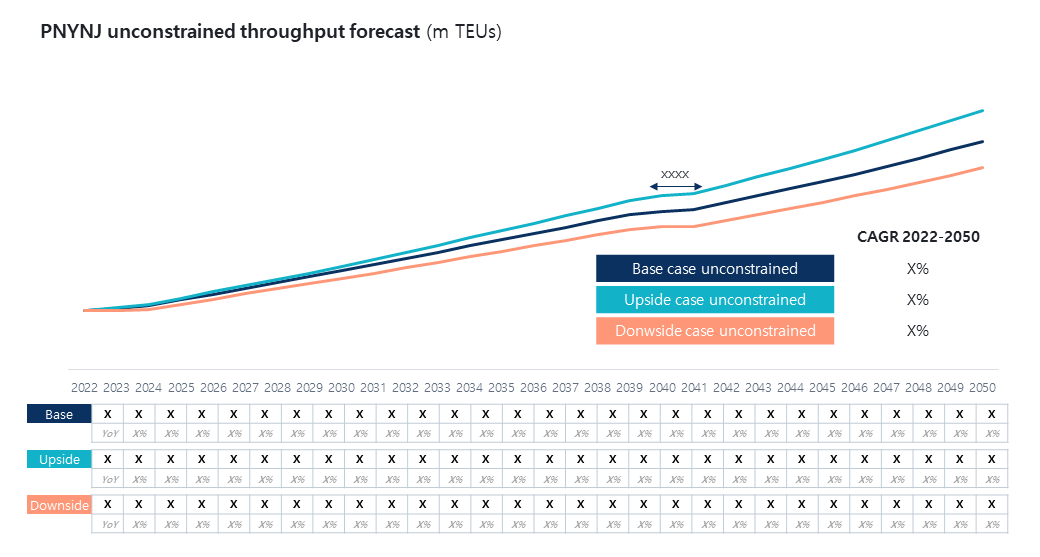

ALG was also asked to develop unconstrained traffic projections for both terminals. This forecast was calculated using a 4-step top-down and bottom-up methodology that considered: the historical growth of US container traffic in relation to US GDP; and bottom-up adjustments that considered factors such as port expansion plans, regional trade lanes and terminal productivity.

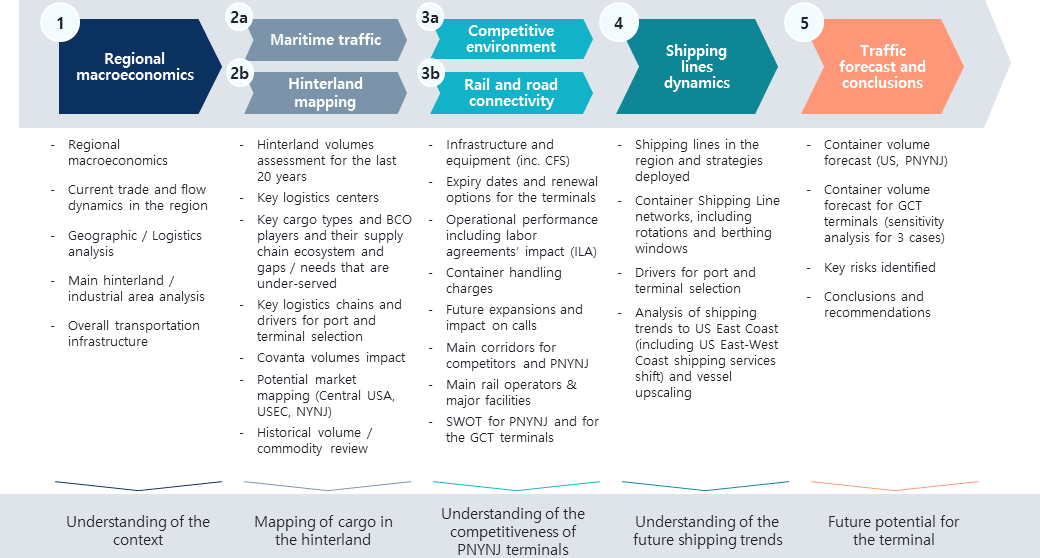

Study methodology and activities

The scope of work includes reviewing the current situation in the market and identifying the drivers that will shape the future competitive landscape.

ALG set the following objectives to obtain this understanding of the market:

- Analysis of the container market on the US East Coast (USEC), specifically in PNYNJ.

- Understanding the hinterland and connectivity of the USEC and PNYNJ.

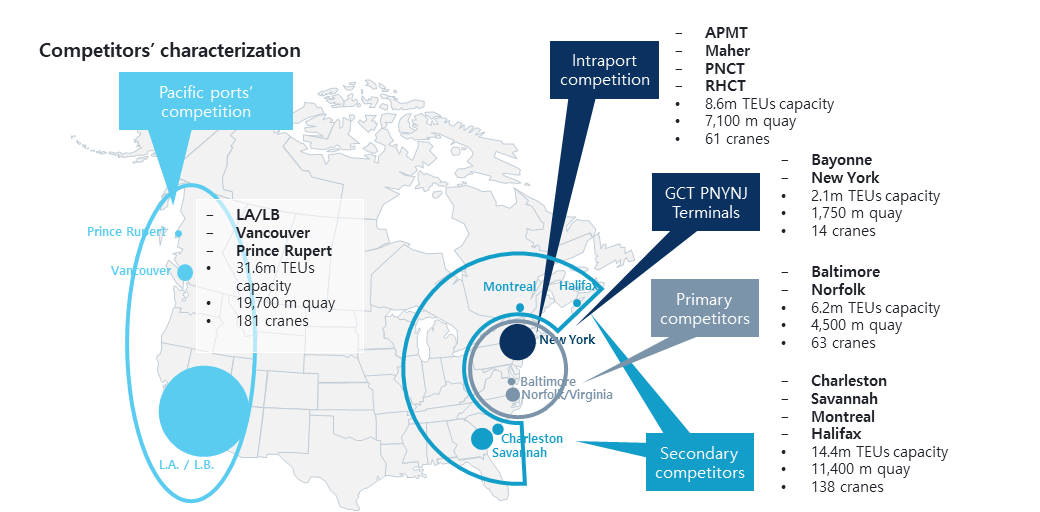

- Description of the competitive landscape in the USEC and PNYNJ and identification of future developments.

- Understanding of the container shipping line networks (all ports), including rotations and berthing windows and future trends.

- Identify the main opportunities for PNYNJ terminals.

- Developing a 30-year traffic forecast for the PNYNJ terminals.

Key findings and recommendations

Through this project, ALG was able to garner greater understanding of the main factors that influence the dynamics of the US container market. ALG identified the following key takeaways from the project:

- Population and GDP:

● North America remains the strongest economic region worldwide and has grown consistently in the past.

● Regional GDP is expected to continue growing consistently in the coming years.

● PNYNJ can cater for the nearby, fast-growing and densely urbanised eastern regions of the continent. - Trade and industry:

● Apart from large volumes of oil, the region’s foreign trade is highly diversified, including food, metals, plastics, ores and other commodities, as well as merchandise and manufacturing products.

● The total value of US trade has been falling over recent years, mainly driven by lower oil imports. Other trade has been growing.

● US manufacturing is concentrated in the Northeast, which is known for its heavy-metal and vehicle industries. - Infrastructure and logistics:

● Consistently with the location of urban consumption centres and manufacturing areas, logistics activities are concentrated in the Eastern part of USA and Canada, with the NY area being the largest logistics hub in the country.

● North America has highly developed national road and rail networks, enabling the transit of cargo from coast to coast.

● The US railway network is dominated by six rail operators, with a dividing line between the eastern and US rail systems at the Mississippi river, making Chicago a key interlinking station for imports.

Success and outcomes

The process was a success as the client was able to use their newfound knowledge of the two assets and the input from the commercial due diligence in the preparation of their bid to acquire the two terminals.