Air transport is a sensitive sector easily affected by socioeconomic and political factors. While traffic can plummet during periods of social turmoil and armed conflicts, it can also recover with relative ease during stability periods following those events.

What does the market indicate?

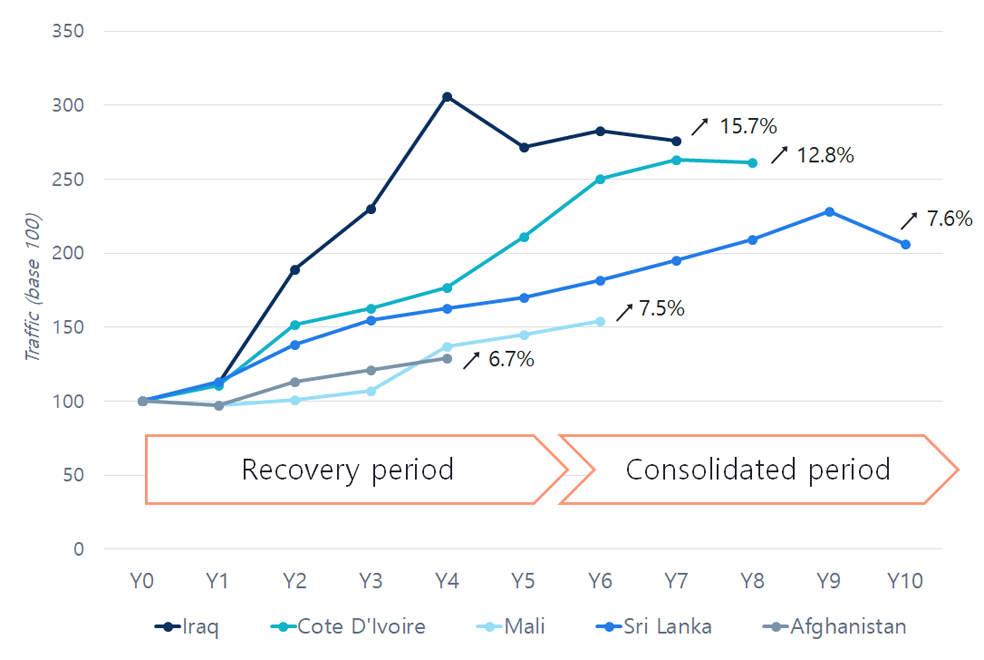

Market stats show that once armed conflicts cease, air transport in the affected countries undergoes a growth pattern that can be divided into two main phases: a recovery period, between years 1 to 5 post-armed conflict; and a consolidation period, from year 5 onwards. From the analysis, it can be derived that during the recovery period seat offering grows aggressively, boosted by the combined effect of national carriers, penetration of new players and network expansions, often achieving double-digit year-on-year growth. It has been observed in benchmarked cases that traffic surges in year 2, with seat offering increasing over 20% compared with the previous year. Afterwards, during the consolidation period, a rationalisation of growth is observed, with seat offering increasing in line with regional average or, in some cases, stagnating.

Evolution of seat offering and CAGR[1][/caption]

Evolution of seat offering and CAGR[1][/caption]

[1] Index traffic on Year 0 (end of armed conflict) = 100

Iraq 2012: US troop withdrawal (December 2011). Cote d’Ivoire 2011: Gbagbo’s arrest (April 2011). Mali 2013: Peace deal with Tuaregs rebels signed (June 2013). Sri Lanka 2009: President declared military victory (May 2009). Afghanistan 2015: End ISAF combat operations (December 2014).

Narrowing the analysis down to airport-level, it has been observed that the country main gateway sets the pace of the sector recovery nationwide. This is particularly valid in countries with large airport networks, where international traffic becomes the main driver of growth (typically >90% of post-conflict new traffic), while domestic traffic remains latent during the recovery period. Domestic traffic tends to sustain steady growth over longer periods as the local economy recovers and, in the countries studied, re-gain over 5 percentage points of market share towards the end of the first post-conflict decade.

Moreover, looking at the market from a propensity to fly perspective, growth rates are similar in all cases, ranging between 5-10% year on year. It is worth mentioning that propensity to fly is growing many times faster than GDP and GDPC, setting air transport as a basic need (and therefore a top priority sector) in post-conflict environments.

Evolution of propensity to fly

Evolution of propensity to fly

Diving deep into the strategies followed by airlines after the end of an armed conflict, two main approaches have been identified:

- Network expansion led by neighbouring local carriers, including the flag carrier: local flag carriers are offering the most capacity and quickly adding new routes connecting with neighbouring countries, once conflicts end. At the same time, national carriers from neighbouring countries start operating routes to the affected country, quickly increasing frequencies to balance-out the offering.

- Hub-feeding generated by global players: Taking advantage of weakened local air transport sectors, while using their hubs as overseas gateways for the affected country. In all the cases analysed, major network carriers have taken over significant market share immediately after armed conflicts, offering high capacity on their feeding routes.

Looking forward: what can countries do to prevent early stagnation?

From a policy perspective, Civil Aviation Authorities often face a dilemma when seeking growth in post-conflict environments. Should they open up to global network carriers or incentivise the steady, yet slower expansion of local and neighbouring flag carriers? Liberalisation policies and the structuring of air service agreements have become the cornerstone for states to support their national sector strategy, setting the tone for the countries’ aviation sector recovery. Best practices indicate that State policies should aim at maximising connectivity of their population within a mid-term planning horizon —i.e. getting towards the end of the Recovery and Consolidation Periods maximising the sector’s sustainable offering. In other words, granting national flag carriers a fair yet challenging period to re-adjust to the global market, and then shifting towards a more liberalised environment to boost competitiveness.

For instance, looking at the African market, neighbour flag carriers tend to push for the 7th freedom routes in post-armed conflict environments, rather than balancing out offering to/from their home bases. On the one hand, this strategy may boost the offering to/from top destinations, while allowing the local flag carriers to develop its own regional network. However, on the other hand, this strategy may corner local flag carriers into low-demand routes, reducing their market share in high-demand ones.

From a regulatory perspective, Civil Aviation Authorities are driven towards the ICAO safety oversight requirements, evaluated under the USOAP programme. Achieving high levels of effective implementation across all eight USOAP audit areas can be a lengthy and complex process for Authorities with limited resources. However, at early stages of sector recovery, two areas strike as quick wins that can be tackled with little investment:

- Primary aviation legislation and civil aviation regulations (LEG), encompassing the country’s aviation law and the general directives of each directorate within the Regulator.

- Civil aviation organisation (ORG), defining the organisational structure of the Authority and capturing the roles and responsibilities of each stakeholder and business units.

These two areas are the pillars upon which a robust civil aviation sector is built, ensuring functional fulfilment of the State’s regulatory obligation, preventing conflicts of interest and ultimately building trust in the global market.

Civil Aviation Authorities in countries affected by armed conflicts tend to concentrate most functions under the same organisation, including Policy, Regulation and Service Provision functions. Concentrating all roles under CAAs enables affected countries to get the most out of limited capital and human resources, yet often incurring in conflicts of interest between functions. It is generally acknowledged that the separation of air navigation and airport management services from regulatory and policy functions —a process often referred to as “de-linking”— tends to improve service delivery and contribute to attracting private-sector investment.

Separating regulatory and service provision functions in developing countries can be achieved via functional de-linking, where regulator and service providers remain under the CAA, but in separate directorates; or organisational de-linking, where service providers are set up as separate legal entities. Developing countries have made efforts to reform their civil aviation sector to align with industry standards, often following a 2-step de-linking process, combining the previous:

- Starting with functional de-linking as soon as the country’s geopolitical situation stabilises, amending its primary law and re-structuring the Authority to meet all their obligations with minimum conflict of interest among directorates.

- Continuing with organisational de-linking of service providers, typically (but not necessarily) beginning with airport management and training institutions, followed by ANS, while closely monitoring financial sustainability of all functions at each stage of the process.

As a final note, the pace set by each country to reform its aviation sector, from both policy and regulatory perspectives, is, to a large extent, driven by the availability of qualified manpower, funding and strong political will.

Main conclusions

-

Following the end of an armed conflict, air transport sectors usually sustain double digit growth over a 5-year period, followed by a period of rationalisation of offering and growth. During this period, the air transport sector tends to grow faster than national economies, signalling an underlying need that is unleashed at the end of the conflicts.

- The offering can be boosted by local carriers opening new routes and expanding the nation’s network, or by global carriers (network carriers) adding high-capacity links to their main hubs and position those as overseas gateways.

- From a policy perspective, the strategy behind air service agreements is crucial during early stages of growth. A fine balance is to be achieved between sustaining local flag carrier’s expansion, without hampering connectivity, aiming at maximising sustainable offering in the mid-term.

From a regulatory perspective, compliance with ICAO legal (LEG) and organization (ORG) audit areas are quick wins to set up solid foundations for the sector’s growth, build trust in the global markets and attract private sector investment.